Friday,

4:13, 2024

| |||||

|

| ||||

| Date and Time |

| Virtual Meeting Site | ||||||||

| www.virtualshareholdermeeting.com/ | ||||||||||

|

| ||||

To elect the nine | FOR the election of each director nominee | ||||

To ratify the appointment of | FOR the ratification of the appointment | ||||

| FOR approval of the executive compensation | ||||

|

| ||||

To transact such other business as may properly come before the meeting or any adjournment or postponement thereof | |||||

| ||

1 | |||||

3 | |||||

3 | |||||

3 | |||||

4 | |||||

4 | |||||

6 | |||||

6 | |||||

6 | |||||

8 | |||||

9 | |||||

9 | |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

|

| ||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| 45 | |||||

| Post-employment Compensation |

| ||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

Potential Payments Upon Termination of Employment or Change-in-Control |

| ||||

| 56 | |||||

| Pay Versus Performance |

| ||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

Householding; Availability of Annual Report on Form 10-K and Proxy Statement |

| ||||

stakeholder engagement. Our sustainability report isreports are organized across three themes:

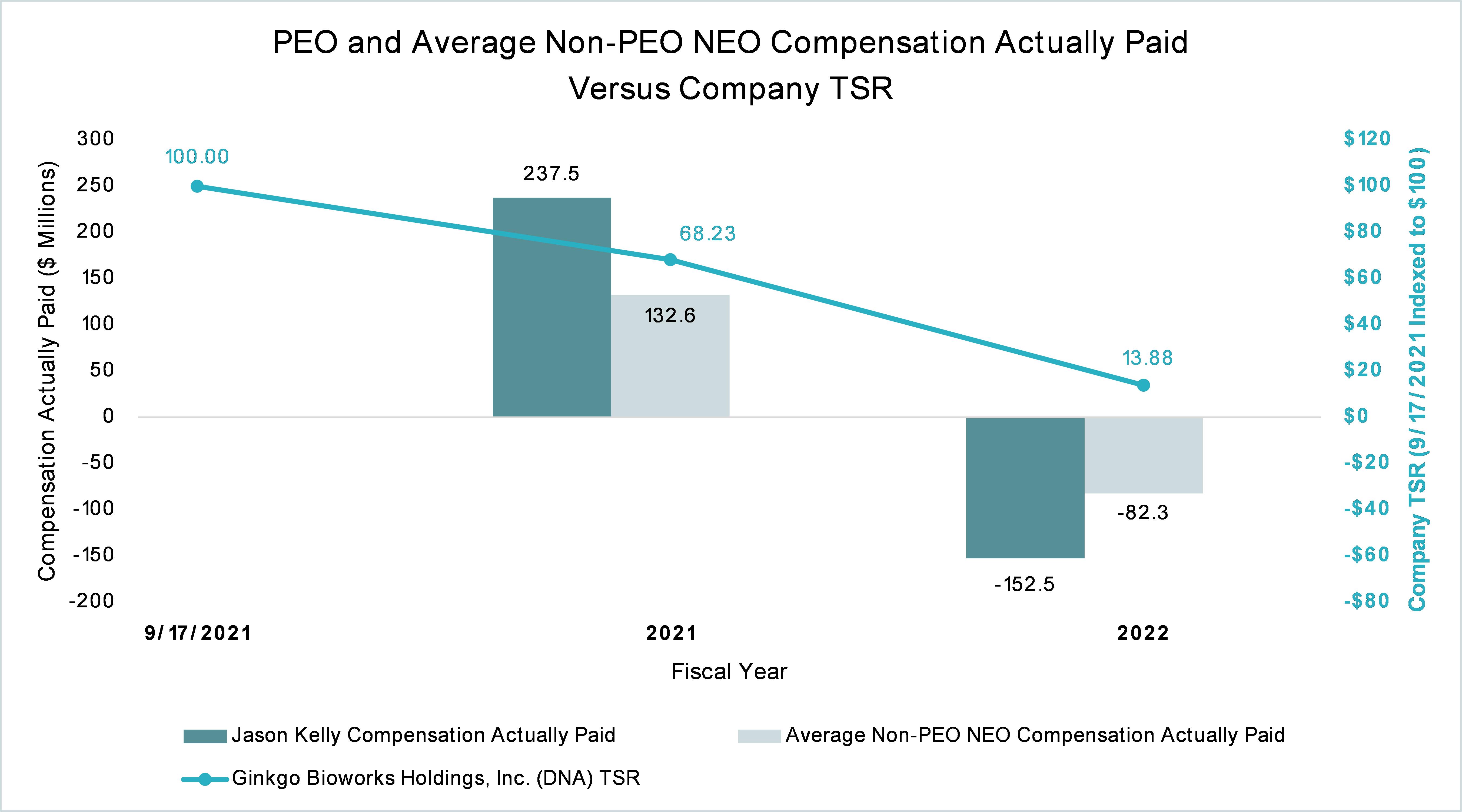

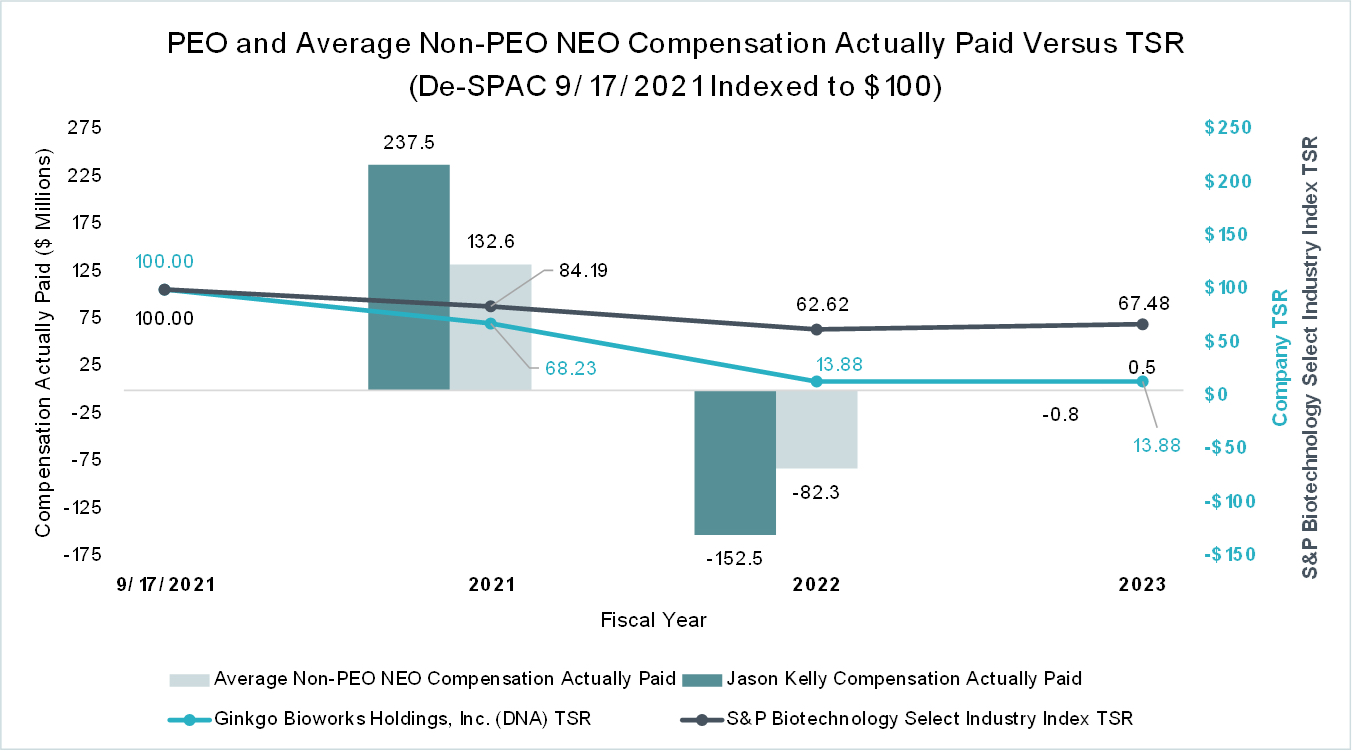

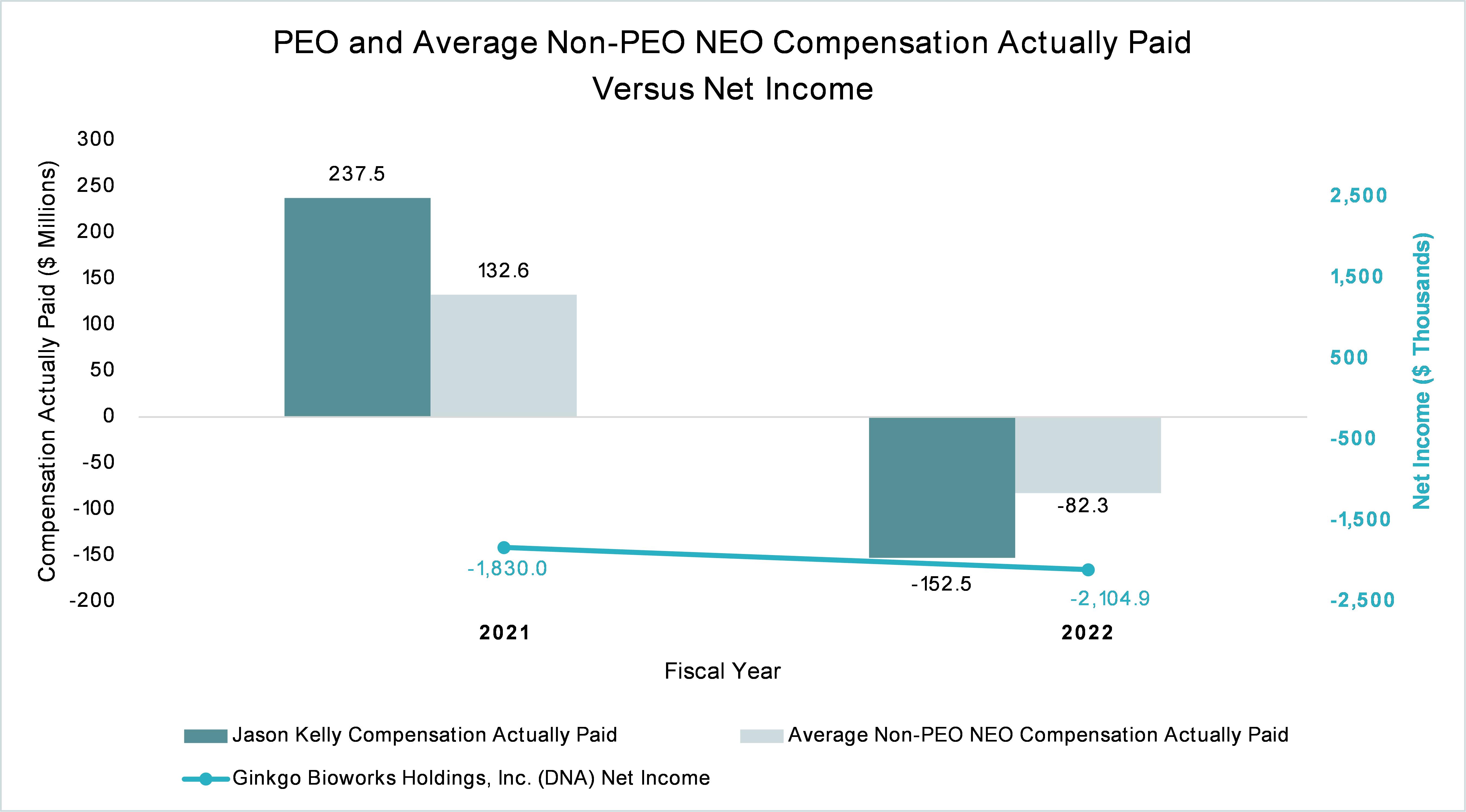

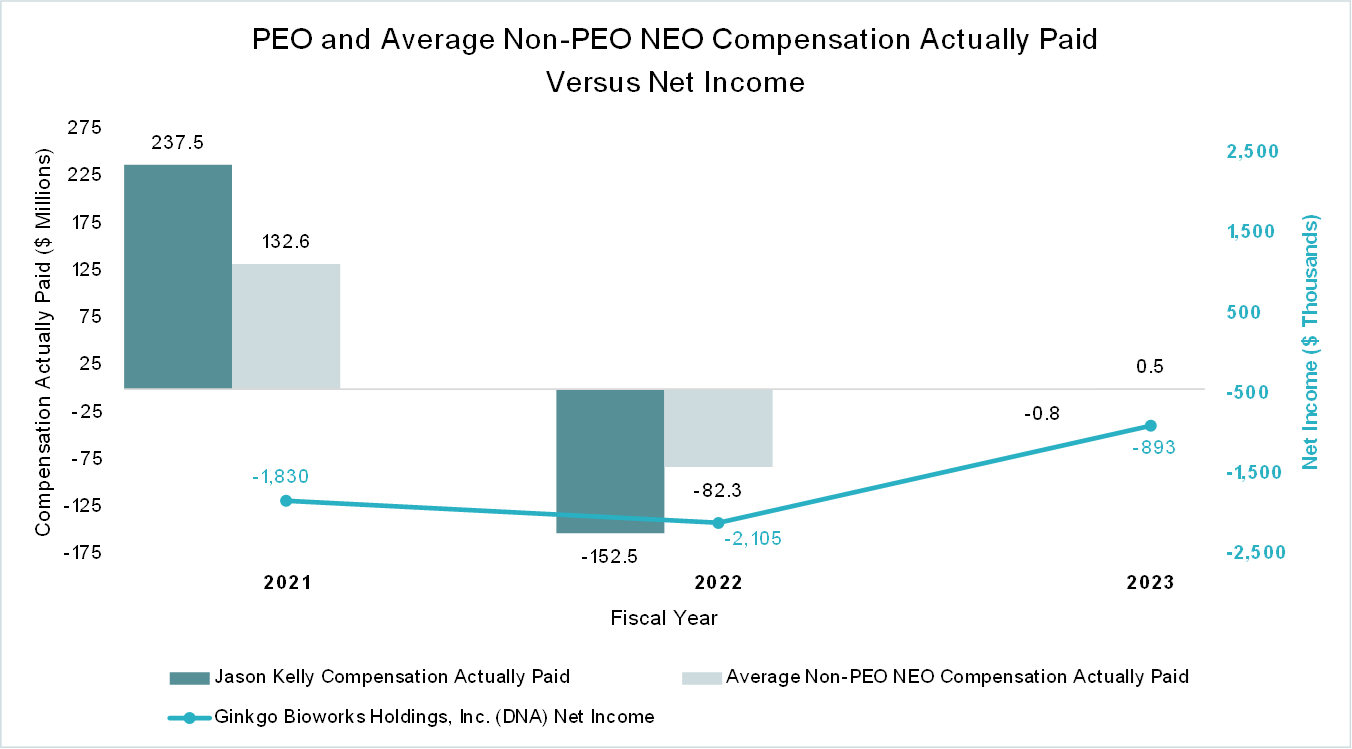

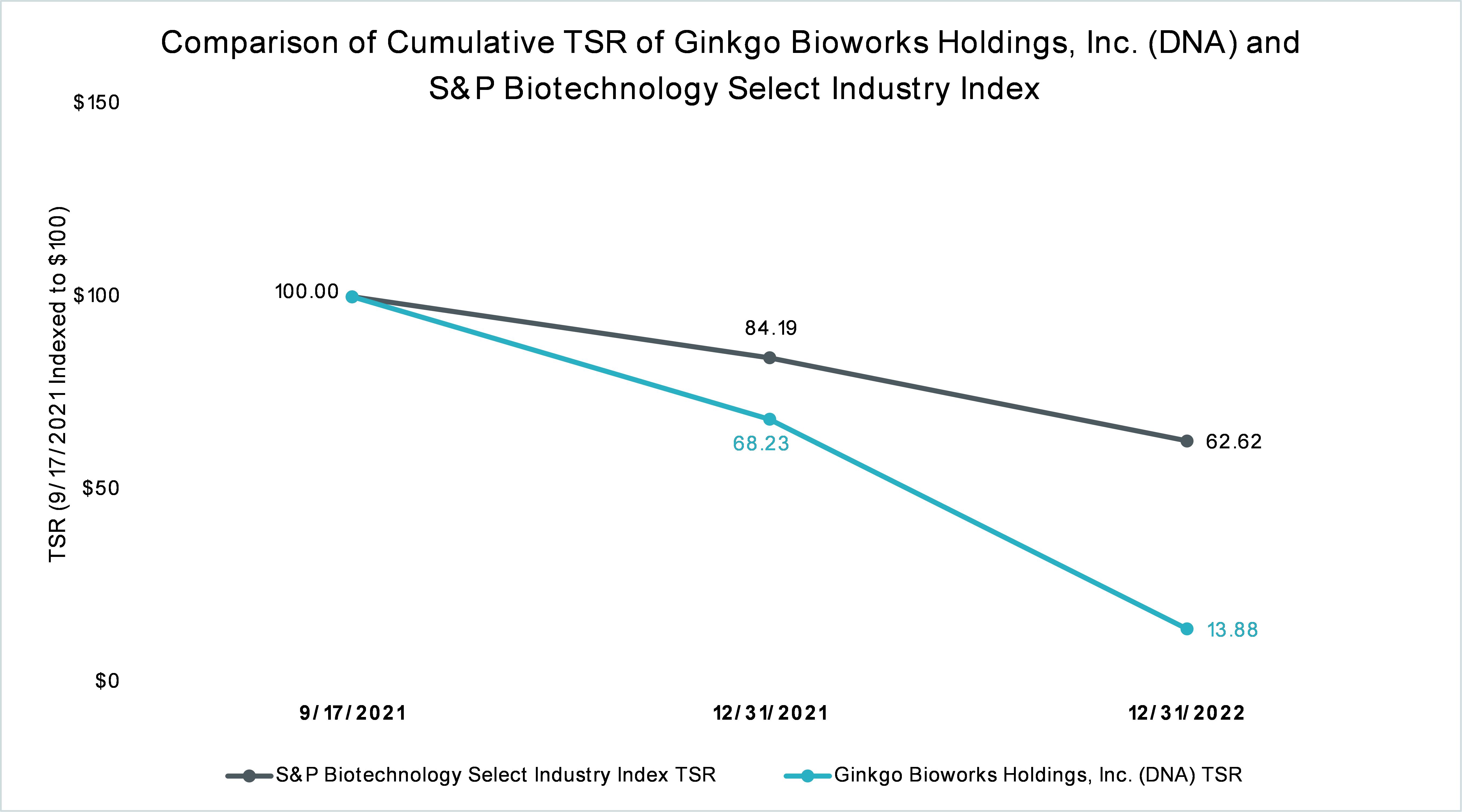

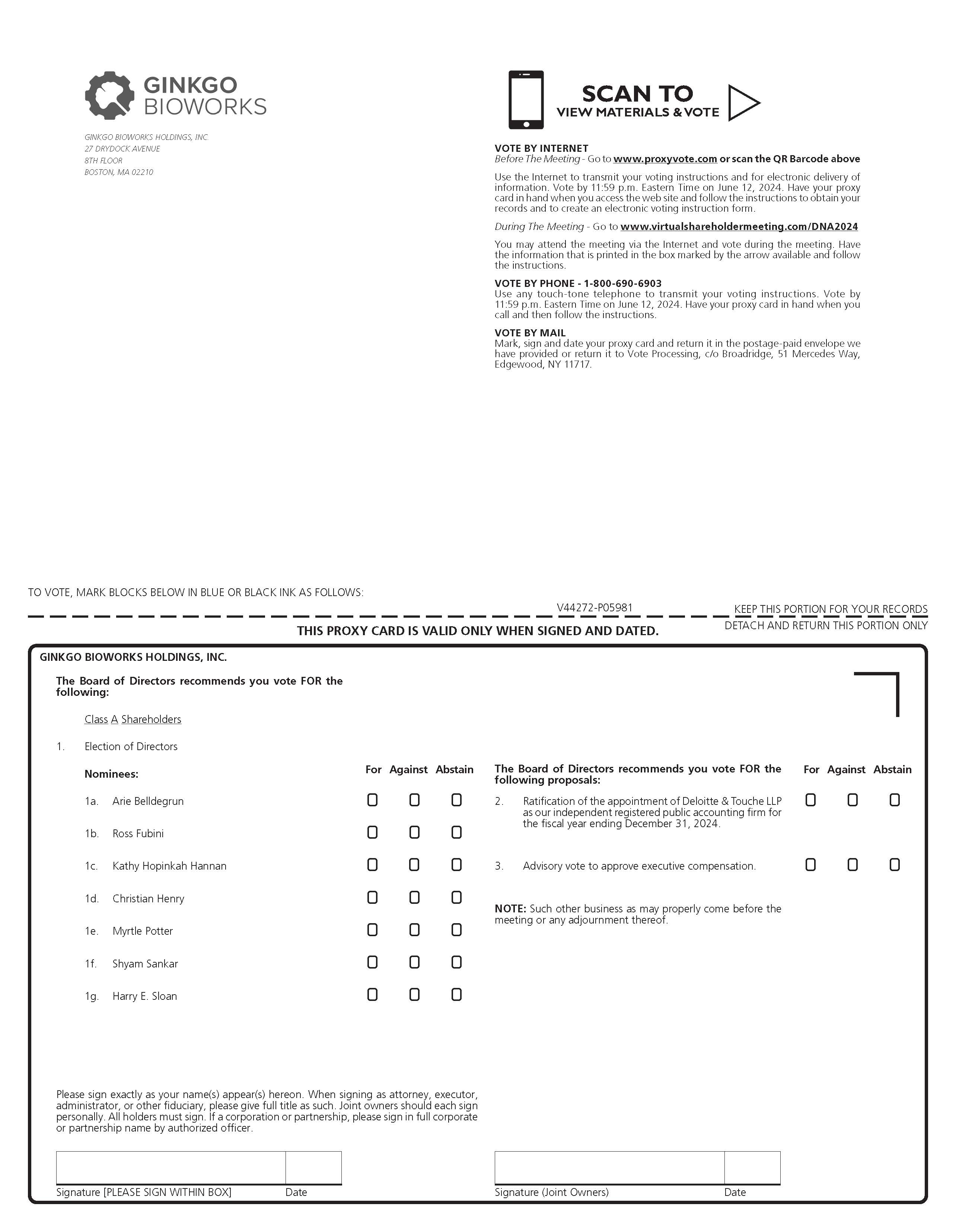

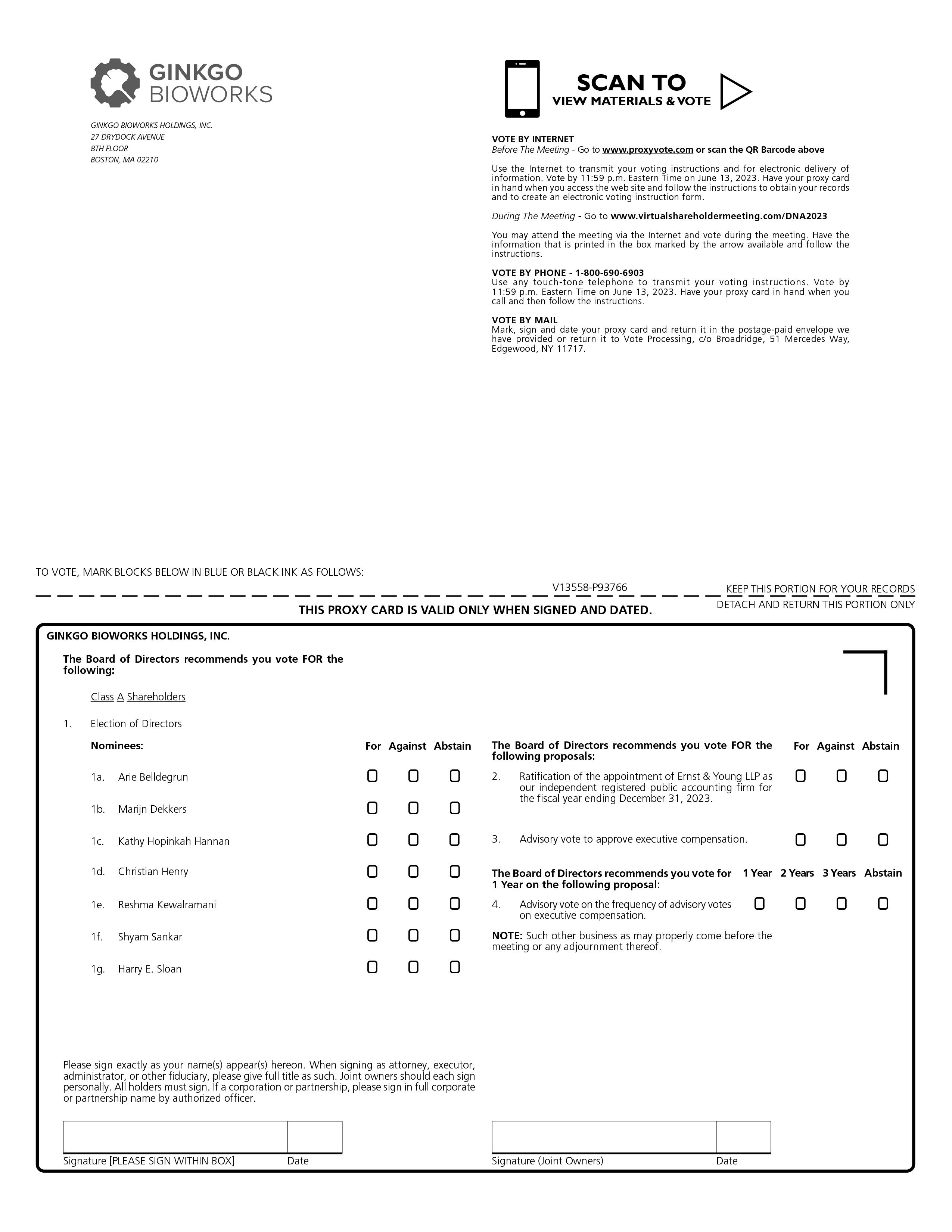

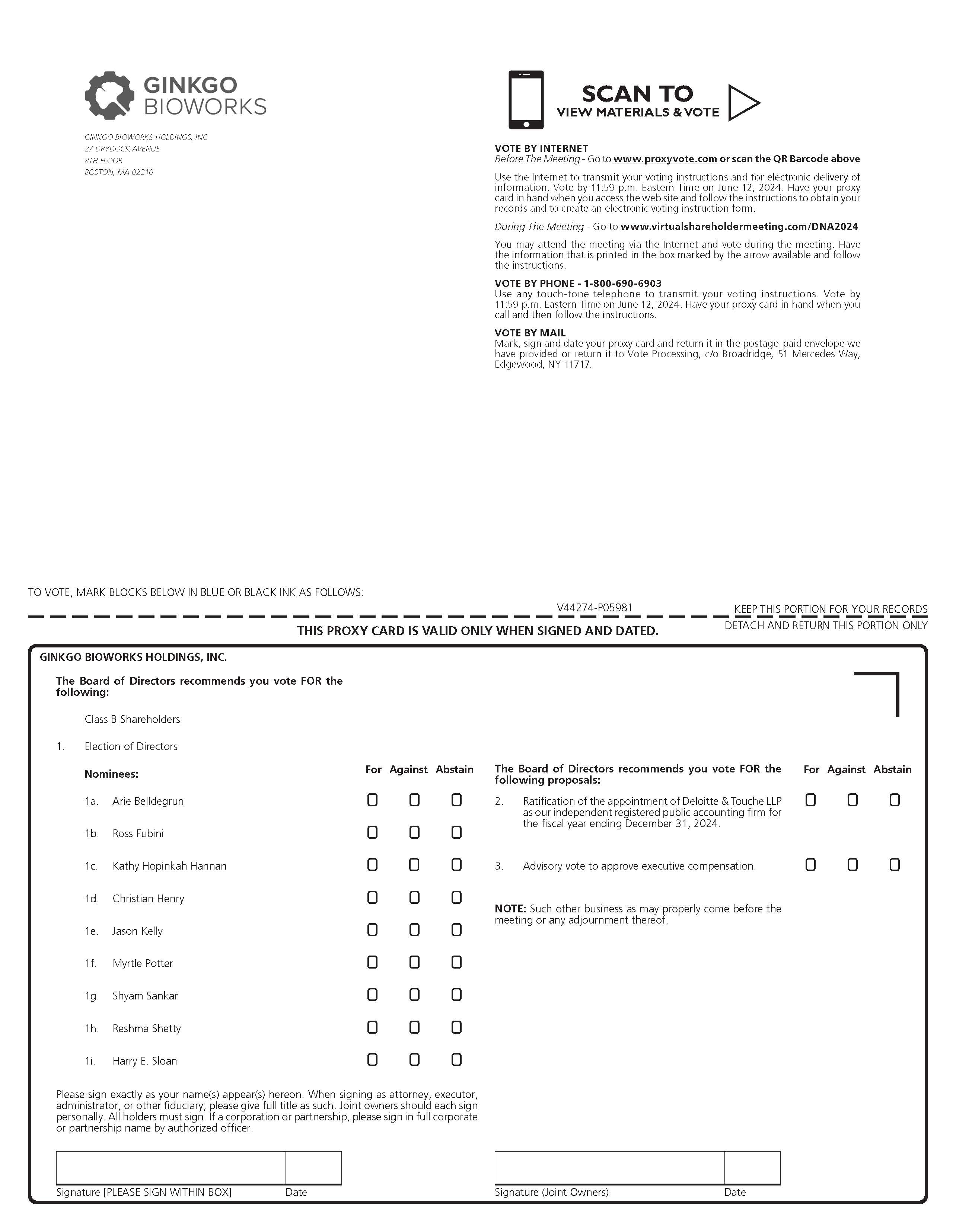

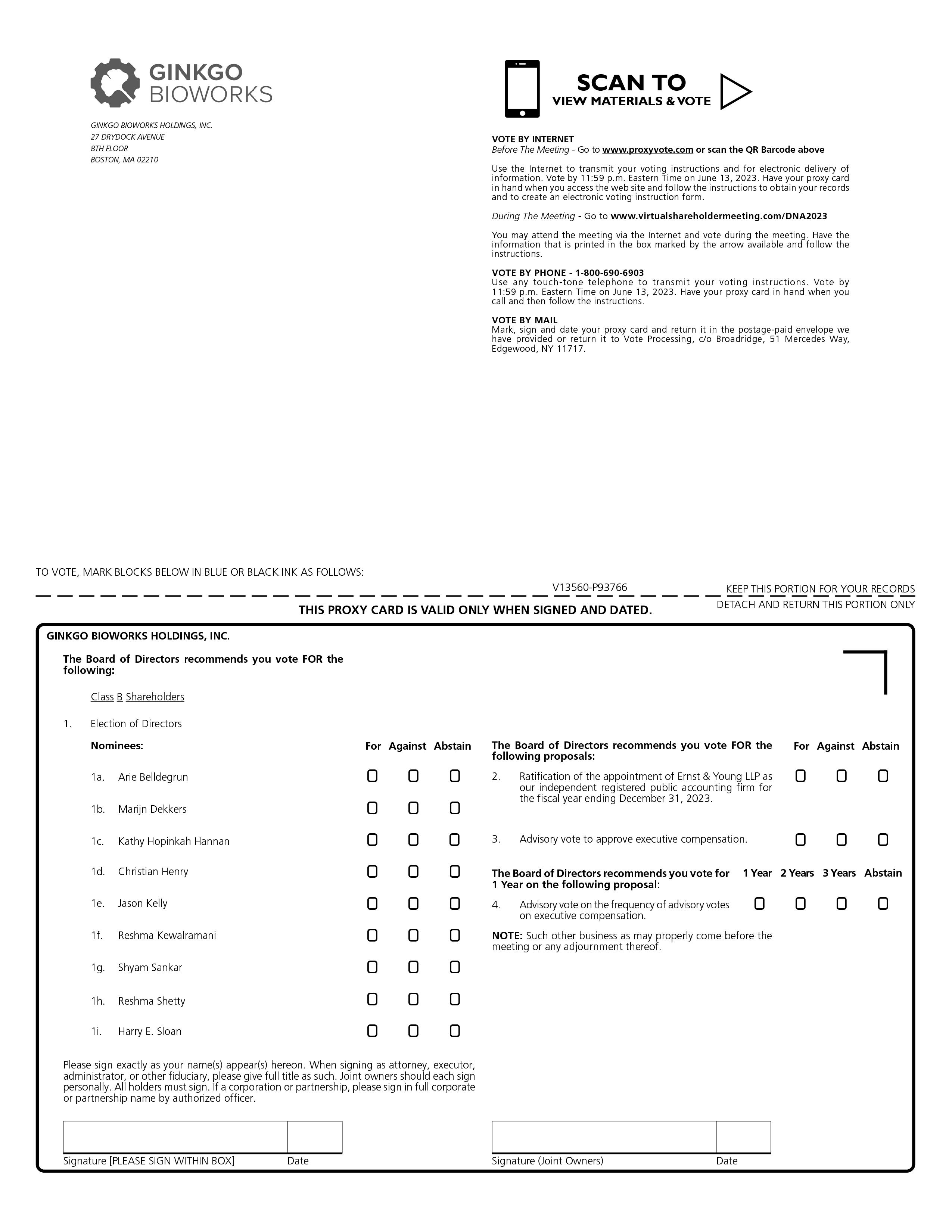

span across multiple programs. biological "radar" system to collect, organize, analyze, and operationalize data on a wide variety of biological threats. 13, 2024 B Directors, which will be voted on only by holders of Ginkgo Class B common stock voting separately as a class, the holders of Ginkgo Class A common stock and the holders of Ginkgo Class B common stock will vote on all matters to be voted on at the Annual Meeting, voting together as a single class. A majority of the common stock votes entitled to be cast at the Annual Meeting, present in person (including present by remote communications) or represented by proxy, constitutes a quorum for the transaction of business at the Annual Meeting. Where a separate vote by class is required on a matter, the holders of a majority in voting power of such class issued and outstanding and entitled to vote, present in person (including present by remote communication) or represented by proxy, shall constitute a quorum for such matter. Abstentions and broker non-votes will be included in determining the presence of a quorum for the Annual Meeting. Jason Kelly Reshma Shetty He is certified by the American Board of Urology and the American Association of Genitourinary Surgeons. track record in advising high-growth tech companies. XYZ Venture Capital Kathy Hopinkah Hannan Christian Henry Chicago. Myrtle Potter & Company, LLC Shyam Sankar Harry E. Sloan contacts. Chairman and Chief Tenure on Board Number of Director Nominees 5-10 Years 10+ Years Two https://investors.ginkgobioworks.com/governance. The Secretary periodically will forward such communications or a summary to the Board or the Chair of the communicate our story and business model; (iii) make accessible company information and performance; and (iv) gather questions and feedback. 2023. Name Audit Compensation Nominating and Total Meetings 6 5 4 date of the Name Fees Earned Stock Option Total ($) Arie Belldegrun 57,500 199,997 306,015 563,512 Marijn E. Dekkers 89,583 199,997 306,015 595,595 Kathy Hopinkah Hannan(3) 20,652 170,958 813,393 1,005,003 Christian Henry 77,500 199,997 306,015 583,512 Reshma Kewalramani 58,944 199,997 306,015 564,956 Shyam Sankar 78,722 199,997 306,015 584,734 Harry E. Sloan 60,000 199,997 306,015 566,012 2023. to or realized by the named individual. We provide information regarding the assumptions used to calculate the grant date fair value of all restricted stock units and options made to our directors in Note 13 to the consolidated financial statements included in our The table below shows the aggregate number of options (exercisable and unexercisable), restricted stock and restricted stock units held as of December 31, Name Options Restricted Stock Restricted Stock Arie Belldegrun 108,516 - 70,921 Marijn E. Dekkers 108,516 281,217 70,921 Kathy Hopinkah Hannan 271,131 - 56,986 Christian Henry 108,516 175,911 163,602 Reshma Kewalramani 177,947 - 70,921 Shyam Sankar 108,516 175,911 70,921 Harry E. Sloan 108,516 - 70,921 2024. Representatives of Ernst & Young LLP ("EY"), the Company’s independent registered public accounting firm for the year ended December 31, 2023, will not be participating in the Annual Meeting and will not be available to respond to appropriate questions from shareholders. Fiscal year ended December 31, 2022 2021 Audit fees (a) $8,262,760 $4,017,109 Audit-related fees (b) — — Tax fees (c) $402,000 $321,794 All other fees (d) — — Total fees $8,664,760 $4,338,903 2022. 2022. Class A common stock Class B common stock % of Name of Beneficial Owner Shares % Shares % % Directors and Executive Officers of Ginkgo — Jason Kelly(1) 9,894,680 * 81,657,653 21.5% 15.4% Reshma Shetty(2) 26,932,798 1.7% 164,094,824 43.1% 31.0% Mark Dmytruk (3) 728,924 * 633,587 * * Arie Belldegrun (4) 593,410 * — — * Marijn Dekkers(5) 7,788,637 * — — * Kathy Hopinkah Hannan 61,986 * - - * Christian Henry (6) 1,295,881 * — — * Reshma Kewalramani 80,739 * — — * Shyam Sankar (7) 1,331,874 * — — * Harry E. Sloan 70,921 * — — * All Directors and Executive Officers 48,779,850 1.7% 246,386,064 64.6% 46.4% 5% Beneficial Owners of Ginkgo Entities affiliated with Anchorage Capital 69,904,593 4.4% — — 1.3% Bartholomew Canton(9) 26,932,798 1.7% 164,094,824 43.1% 31.0% Austin Che(10) 16,294,686 1.0% 80,147,413 21.1% 15.2% Entities affiliated with Baillie Gifford & Co.(11) 244,176,643 15.5% — — 4.5% Cascade Investment, L.L.C. (12) 151,865,481 9.6% — — 2.8% Thomas Knight(13) 62,443,355 4.0% 8,972,183 2.4% 2.8% Viking Global Investors L.L.C (14) 143,085,126 9.1% — — 2.7% The Vanguard Group (15) 101,521,280 6.4% — — 1.9% ARK Investment Management LLC (16) 144,384,067 9.1% — — 2.7% Name Age Position Jason Kelly Chief Executive Officer and Founder; Director Reshma Shetty President, Chief Operating Officer and Founder; Director Mark Dmytruk Chief Financial Officer leadership team based on this market data as well as the level of achievement of the Company’s objectives and key results for the year, as described above. The Compensation Committee reviews and discusses this information and the recommendation by our Chief Executive Officer and President & Chief Operating Officer, and then determines changes to cash compensation and the grant of equity compensation, if any. 10X Genomics, Inc. Abcellera Biologics Inc BridgeBio Pharma, Inc. CRISPR Therapeutics AG Guardant Health, Inc. Ionis Pharmaceuticals, Inc. Livent Corp. Repligen Corporation Schrödinger, Inc. Twist Bioscience Corporation Ultragenyx Pharmaceutical Inc. Vir Biotechnology, Inc. Name Jason Kelly Reshma Shetty Mark Dmytruk . to the shareholders of Old Ginkgo, restricted stock. These restricted stock earnout awards are subject to the same service-based vesting schedule as the related restricted stock units and 2027, generally subject to Mr. Dmytruk’s continued service to the Company through the applicable vesting date. Name and Principal Position Year Salary Bonus Stock All Other Total Jason Kelly 2022 250,000 - 12,500 262,500 Chief Executive Officer 2021 250,000 - 380,479,776(4) 12,500 380,742,276 2020 250,000 414,841 9,854,097 14,250 10,533,188 Reshma Shetty 2022 250,000 - - 12,500 262,500 President & Chief 2021 250,000 - 380,479,776(4) 12,500 380,742,276 2020 250,000 415,386 9,854,097 14,250 10,533,733 Mark Dmytruk 2022 450,000 - 1,730,200 15,250 2,195,450 Chief Financial Officer 2021 425,000 - 39,629,178(4) 14,500 40,068,678 2020 63,750 - - 2,861 66,611 2021. original grants to Dr. Kelly and Dr. Shetty associated with these amounts were granted under Dr. Kelly and Dr. Shetty’s founder equity grant agreements with Old Ginkgo, which were entered into in January 2020 prior to the Business Combination and resulted in no incremental dilution to shareholders following the Business Combination as they were granted prior to Ginkgo becoming a publicly traded company. We provide information regarding the assumptions used to calculate the fair value of all restricted stock units and associated restricted stock earnout awards made to named executive officers in Note 13 to the consolidated financial statements included in our Name Grant Date All Other Stock Awards: Number of Shares of Stock or Units (#) Grant Date Fair Value of Stock and Option Awards ($)(1) Jason Kelly - - - Reshma Shetty - - - Mark Dmytruk 1/24/2022(2) 40,000 205,200 3/11/2022(3) 500,000 1,525,000 Stock Awards Name Grant Date Number of Market Value of Equity Incentive Equity Incentive Jason Kelly 1/1/2020 - - 389,151 (6) 657,665 8/18/2021 - - 1,931,19 (6) 3,263,716 Reshma Shetty 1/1/2020 - - 389,151 (6) 657,665 8/18/2021 - - 1,931,193 (6) 3,263,716 Mark Dmytruk 3/2/2021 1,058,298 (1) 1,788,524 - - 3/2/2021 31,750 (7) 53,658 198,768 (6) 335,918 4/4/2021 32,688 (2) 55,243 - - 4/4/2021 982 (7) 1,660 5,883 (6) 9,942 8/2/2021 221,885 (3) 374,986 - - 8/2/2021 6,658 (7) 11,252 30,918 (6) 52,251 1/24/2022 40,000 (4) 67,600 - - 3/11/2022 406,250 (5) 686,563 - - applicable vesting date. applicable vesting date. the applicable vesting date. Stock Awards Name Number of Shares Acquired on Vesting (#) Value Realized on Vesting ($)(1) Jason Kelly 26,555,807 82,854,118 Reshma Shetty 26,555,807 82,854,118 Mark Dmytruk 767,775 2,803,677 Change in Control control of Ginkgo. Name Severance ($) Health Benefits Continuation ($)(1) Total ($)(2) Mark Dmytruk Involuntary Termination Without Cause 450,000 13,522 463,522 CEO Pay Ratio (a) (b) (c) (d) (e) (f) (g) (h) 2022 262,500 (152,520,622) 1,228,975 (82,295,312) 13.88 62.62 (2,105) 2021 380,742,276 237,508,511 210,405,477 132,638,554 68.23 84.19 (1,830) Mark Dmytruk Year Summary Compensation Table Total for Jason Kelly Exclusion of Stock Awards for Jason Kelly Inclusion of Equity Values for Jason Kelly Compensation Actually Paid to Jason Kelly 2022 262,500 — (152,783,122) (152,520,622) 2021 380,742,276 (380,479,776) 237,246,011 237,508,511 Year Average Summary Compensation Table Total for Non-PEO NEOs Average Exclusion of Stock Awards for Non-PEO NEOs Average Inclusion of Equity Values for Non-PEO NEOs Average Compensation Actually Paid to Non-PEO NEOs 2022 1,228,975 (865,100) (82,659,187) (82,295,312)) 2021 210,405,477 (210,054,477) 132,287,554 132,638,554 Year Year-End Fair Value of Equity Awards Granted During Year That Remained Unvested as of Last Day of Year for Jason Kelly Change in Fair Value from Last Day of Prior Year to Last Day of Year of Unvested Equity Awards for Jason Kelly Vesting-Date Fair Value of Equity Awards Granted During Year that Vested During Year for Jason Kelly Change in Fair Value from Last Day of Prior Year to Vesting Date of Unvested Equity Awards that Vested During Year for Jason Kelly Fair Value at Last Day of Prior Year of Equity Awards Forfeited During Year for Jason Kelly Total - Inclusion of 2022 — (14,958,483) — (137,824,639) — (152,783,122) 2021* 197,456,762 39,789,249 — — — 237,246,011 Year Average Year-End Fair Value of Equity Awards Granted During Year That Remained Unvested as of Last Day of Year for Non-PEO NEOs Average Change in Fair Value from Last Day of Prior Year to Last Day of Year of Unvested Equity Awards for Non-PEO NEOs Average Vesting-Date Fair Value of Equity Awards Granted During Year that Vested During Year for Non-PEO NEOs Average Change in Fair Value from Last Day of Prior Year to Vesting Date of Unvested Equity Awards that Vested During Year for Non-PEO NEOs Average Fair Value at Last Day of Prior Year of Equity Awards Forfeited During Year for Non-PEO NEOs Total - Average Inclusion of 2022 377,082 (12,714,543) 134,948 (70,456,674) — (82,659,187) 2021* 107,988,581 19,894,625 4,404,348 — — 132,287,554 (“TSR”) 2023. 2024. error. in the future to receive only a single copy at your address, please contact HouseholdingAfter all, throughoutThe 2022 Sustainability Report came as the past year, the power of biology has become even more widely recognized. In fact, in September 2022, Jake Sullivan—President Biden’s national security adviser—announced that the U.S. government expects biotechnologyWhite House and others are increasingly looking to have “outsized importance over the coming decade” in the context of geopolitical competition, because of the ability to “read, write, and edit genetic code, which has rendered biology programmable.”To this end, President Biden issued an Executive Order on Advancing Biotechnology and Biomanufacturing for a Sustainable, Safe and Secure American Bioeconomy and the U.S. government has launched a new National Biotechnology and Biomanufacturing Initiative. Both are meant to unlock synthetic biology innovations for health, climate change, energy, food security, agriculture,and biomanufacturing as key to reducing global emissions, improving supply chain resilience, and nationaladvancing human health. As detailed in the report, Ginkgo's platform helps enable leading pharmaceutical, food, and economic security.agriculture companies to develop more sustainable solutions.The report also highlights how Ginkgo is strengthening its organizational processes to support its commitment to care how its platform is developed and used as the company grows. For example, among other goals,last July Ginkgo employees elected nine representatives to its Caring Committee. The Caring Committee works with teams across Ginkgo to facilitate assessment, deliberation, and engagement about the new initiative aspirespotential impacts of our activities. A key operational component involves asking the critical questions about benefits, risks and unintended consequences, which are integrated within a Cost, Caring, and Risk Assessment ("CCRA") scoping document that is part of our program launch process. Between their election in July 2022 and the end of Q1 2023, the Caring Committee reviewed over 100 CCRAs spanning markets including pharma, agriculture, bio-industrials, nutrition and wellness, government, and biosecurity. The committee facilitates a variety of strategies to leverage synthetic biologypromote benefits and mitigate risks, including designing alternative technical approaches, implementing legal guardrails, and working to reduce emissions in agriculture,identify experts and to produce at least 30% of the U.S. chemical demand via sustainable bio-manufacturing pathways. The Biden Administration also released a National Biodefense Strategy and Implementation Plan, underscoringadvocate for needs that advances in biotechnology must be accompanied by robust capabilities to counter biological threats, whether naturally-occurring, accidental, or deliberate.We no longer question if biotechnology will transform a given industry, we simply question whether we are creative enough to imagine how. The modern tools of biotechnology, when deployed at scale, offer an unprecedented opportunity to transform the way the world detects and responds to pandemics. With this in mind, we are working to expand our biosecurity offering and to deploy new capabilities to prepare for future biological threats. For example, we are collaborating1Ginkgo's biosecurity business unit is working to build critical infrastructure to monitor biological threats—supporting public health and national security. Ginkgo further developed and expanded its work with the Ukraine Ministry of Health to launch a wastewater testing pilot program to1inform decisions to help reduce the infectious disease burden on the Ukrainian population and healthcare infrastructure.We launched our biosecurity and public health unit, Concentric by Ginkgo, at the beginning of the COVID-19 pandemic. Since then, we have tested over 11 million individual samples and sequenced more than 51,000 viral genomes. Beyond the U.S., we now have active programs, pilots, or Memoranda of Understanding in nine countries, ranging from piloting agricultural monitoring of antimicrobial resistance in Australia to expansion of our travel biosecurity program.We partner with the U.S. Centers for Disease Control and Prevention to operate thePrevention's (CDC's) Traveler-based SARS-CoV-2 Genomic Surveillance program at seven major international airports(TGS), publishing weekly variant analysis, developing new tools and methodologies for monitoring aircraft wastewater, and demonstrating proof-of-concept for additional pathogen monitoring. Ginkgo also announced the creation of ENDAR, a tool that could help deter misuse of engineered biology, in partnership with the U.S. (JFK, EWR, SFO, ATL, SEA, LAX, and IAD)Intelligence Advanced Research Projects Activity (IARPA). The program detected Omicron sublineages BA.2 and BA.3 one and six weeks, respectively, before they were reported in the U.S., and has been earlyThese developments are emblematic of Ginkgo's vision to detect several other emerging variants, maximizing time for response and development of medical countermeasures. We are working to launch analogous programs internationally as we establishbuild a global pathogen monitoring network.Later this year, we will release an update to our 20212022 Sustainability Report, Caring at Ginkgo. The update will elaborate on our approach to care across each of our three thematic areas. After all, our long-term commitment to care drives our engagement with customers who seek positive long-term impact, efforts in building large-scale biosecurity, and our culture and modes of governance.22GINKGO BIOWORKS HOLDINGS, INC.PROXY STATEMENTANNUAL MEETING OF SHAREHOLDERSTo Be Held on Thursday, June 16, 2023ANNUAL MEETING INFORMATIONGeneralThe enclosed proxy is solicited by the Board of Directors (the “Board”) of Ginkgo Bioworks Holdings, Inc. (“Ginkgo” or the “Company”) for the Annual Meeting of Shareholders to be held at 4:8:00 p.m.a.m., Eastern Time, on Friday,Thursday, June 16, 2023,13, 2024, and any adjournment or postponement thereof. We will conduct a virtual online Annual Meeting this year, so our shareholders can participate from any geographic location with Internet connectivity. We believe this enhances accessibility to our Annual Meeting for all of our shareholders and reduces the carbon footprint of our activities. Shareholders may participate in the Annual Meeting at www.virtualshareholdermeeting.com/DNA2023DNA2024 and may submit questions during or in advance of the Annual Meeting. Our principal offices are located at 27 Drydock Avenue, 8th Floor, Boston, Massachusetts 02210. This Proxy Statement is first being made available to our shareholders on or about April 28, 2023.29, 2024.Outstanding Securities and QuorumOnly holders of record of our Class A common stock, par value $0.0001 per share (“Ginkgo Class A common stock”), and Class B common stock, par value $0.0001 per share (“Ginkgo Class B common stock” and, together with the Ginkgo Class A common stock, the “common stock”), at the close of business on Thursday,Tuesday, April 20, 2023,16, 2024, the record date, will be entitled to notice of, and to vote at, the Annual Meeting. Holders of our Class C common stock, par value $0.0001 per share (“Ginkgo Class C common stock”) have no voting rights (except as otherwise expressly provided in our amended and restated certificate of incorporation (the “Charter”) or required by applicable law). On the record date, we had 1,580,358,3261,700,266,443 shares of Ginkgo Class A common stock and 380,373,382382,544,655 shares of Ginkgo Class B common stock outstanding and entitled to vote. Each holder of record of Ginkgo Class A shares of common stock on that date will be entitled to one vote for each share held on all matters to be voted upon by holders of Ginkgo Class A common stock at the Annual Meeting. Each holder of record of Ginkgo Class B shares of common stock on that date will be entitled to ten votes for each share held on all matters to be voted upon at the Annual Meeting. For so long as the outstanding shares of Ginkgo Class B common stock represent at least 2% of all outstanding shares of Ginkgo Class A common stock, Ginkgo Class B common stock and Ginkgo Class C common stock, the holders of Ginkgo Class B common stock, voting separately as a class, shall be entitled to nominate and elect a number of directors equal to one-quarter of the total3number of directors of the Company (the “Class B Directors”). Other than the election of Class3Internet Availability of Proxy MaterialsWe are furnishing proxy materials to our shareholders via the Internet by mailing a Notice of Internet Availability of Proxy Materials, instead of mailing or emailing copies of those materials. The Notice of Internet Availability of Proxy Materials directs shareholders to a website where they can access our proxy materials, including our proxy statement and our annual report, and view instructions on how to vote via the Internet, mobile device, or by telephone. If you received a Notice of Internet Availability of Proxy Materials and would prefer to receive a paper copy of our proxy materials, please follow the instructions included in the Notice of Internet Availability of Proxy Materials.We encourage you to register to receive all future shareholder communications electronically, instead of in print. This means that access to the annual report, proxy statement, and other correspondence will be delivered to you via email.Proxy VotingShares that are properly voted via the Internet, mobile device, or by telephone or for which proxy cards are properly executed and returned will be voted at the Annual Meeting in accordance with the directions given or, in the absence of directions, will be voted in accordance with the Board’s recommendations as follows: “FOR” the election of each of the nominees to the Board named herein; “FOR” the ratification of the appointment of our independent registered public accounting firm; and “FOR” the approval of executive compensation; and to conduct advisory votes on executive compensation “EVERY YEAR.”compensation. It is not expected that any additional matters will be brought before the Annual Meeting, but if other matters are properly presented, the persons named as proxies in the proxy card(s) or their substitutes will vote in their discretion on such matters.Voting via the Internet, mobile device, or by telephone helps save money by reducing postage and proxy tabulation costs and reduces the carbon footprint of our activities. To vote by any of these methods, read this Proxy Statement, have your Notice of Internet Availability of Proxy Materials, proxy card(s), or voting instruction form in hand, and follow the instructions below for your preferred method of voting. Each of these voting methods is available 24 hours per day, seven days per week.44We encourage you to cast your vote by one of the following methods:

VOTE BY INTERNETShares Held of Record:http://www.proxyvote.comVOTE BY QR CODEShares Held of Record:See Proxy Card(s)VOTE BY TELEPHONEShares Held of Record:800-690-6903Shares Held in Street Name:See Notice of InternetAvailability or VotingInstruction FormShares Held in Street Name:See Notice of InternetAvailability or VotingInstruction FormShares Held in Street Name:See Voting Instruction FormThe manner in which your shares may be voted depends on how your shares are held. If you own shares of record, meaning that your shares are represented by certificates or book entries in your name so that you appear as a shareholder on the records of Computershare, our stock transfer agent, you may vote by proxy, meaning you authorize individuals named in the proxy card(s) to vote your shares. If you have received paper copies of our proxy materials, are voting by mail, and have received a proxy card for Class A common stock and a proxy card for Class B common stock, you must sign and return both proxy cards in accordance with their respective instructions or submit a proxy, via the Internet, mobile device or telephone, with respect to both Class A common stock and Class B common stock in order to ensure the voting of the shares of each class owned. You also may participate in and vote during the Annual Meeting. If you own common stock of record and you do not vote by proxy or at the Annual Meeting, your shares will not be voted.If you own shares in street name, meaning that your shares are held by a bank, brokerage firm, or other nominee, you may instruct that institution on how to vote your shares. You may provide these instructions by voting via the Internet, mobile device, by telephone, or (if you have received paper copies of proxy materials through your bank, brokerage firm, or other nominee) by returning a voting instruction form received from that institution. You also may participate in and vote during the Annual Meeting. If you own common stock in street name and do not either provide voting instructions or vote during the Annual Meeting, the institution that holds your shares may nevertheless vote your shares on your behalf with respect to the ratification of the appointment of

VOTE BY INTERNETShares Held of Record:http://www.proxyvote.comVOTE BY QR CODEShares Held of Record:See Proxy Card(s)VOTE BY TELEPHONEShares Held of Record:800-690-6903Shares Held in Street Name:See Notice of InternetAvailability or VotingInstruction FormShares Held in Street Name:See Notice of InternetAvailability or VotingInstruction FormShares Held in Street Name:See Voting Instruction FormThe manner in which your shares may be voted depends on how your shares are held. If you own shares of record, meaning that your shares are represented by certificates or book entries in your name so that you appear as a shareholder on the records of Computershare, our stock transfer agent, you may vote by proxy, meaning you authorize individuals named in the proxy card(s) to vote your shares. If you have received paper copies of our proxy materials, are voting by mail, and have received a proxy card for Class A common stock and a proxy card for Class B common stock, you must sign and return both proxy cards in accordance with their respective instructions or submit a proxy, via the Internet, mobile device or telephone, with respect to both Class A common stock and Class B common stock in order to ensure the voting of the shares of each class owned. You also may participate in and vote during the Annual Meeting. If you own common stock of record and you do not vote by proxy or at the Annual Meeting, your shares will not be voted.If you own shares in street name, meaning that your shares are held by a bank, brokerage firm, or other nominee, you may instruct that institution on how to vote your shares. You may provide these instructions by voting via the Internet, mobile device, by telephone, or (if you have received paper copies of proxy materials through your bank, brokerage firm, or other nominee) by returning a voting instruction form received from that institution. You also may participate in and vote during the Annual Meeting. If you own common stock in street name and do not either provide voting instructions or vote during the Annual Meeting, the institution that holds your shares may nevertheless vote your shares on your behalf with respect to the ratification of the appointment of ErnstDeloitte & YoungTouche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023,2024, but cannot vote your shares on any other matters being considered at the meeting.55Voting StandardThe affirmative vote of a plurality of the outstanding shares of the Ginkgo Class B common stock present or represented by proxy and entitled to vote on the election is required to elect Jason Kelly and Reshma Shetty, the Class B Directors, to the Board. The affirmative vote of a plurality of the common stock votes cast (voting together as a single class) present or represented by proxy and entitled to vote on the election is required to elect the other seven nominees for director to the Board. Abstentions and broker non-votes will have no effect on the outcome of the election. Broker non-votes occur when a person holding shares in street name, such as through a brokerage firm, does not provide instructions as to how to vote those shares and the broker does not then vote those shares on the shareholder’s behalf.For all other matters proposed for a vote at the Annual Meeting, the affirmative vote of a majority of the votes of the outstanding shares of common stock present or represented by proxy and entitled to vote on the matter is required to approve the matter, with holders of Ginkgo Class A common stock and holders of Ginkgo Class B common stock voting together as a single class. For these matters, broker non-votes, if any, and abstentions will not be treated as votes cast and, therefore, will have no effect on the outcome of the votes. A broker non-vote occurs when shares held by a broker are not voted with respect to a particular proposal because the broker does not have discretionary authority to vote on the matter and has not received voting instructions from its clients. If your broker holds your shares in its name and you do not instruct your broker how to vote, your broker will only have discretion to vote your shares on “routine” matters. Where a proposal is not “routine,” a broker who has not received instructions from its clients does not have discretion to vote its clients’ uninstructed shares on that proposal. Because Proposal 2 is considered a routine matter, your broker will have discretionary authority to vote on this matter.RevocationIf you own common stock of record, you may revoke your proxy or change your voting instructions at any time before your shares are voted at the Annual Meeting by delivering to the Secretary of Ginkgo a written notice of revocation or a duly executed proxy (via the Internet, mobile device, telephone or by returning your proxy card(s)) bearing a later date or by participating in and voting during the Annual Meeting. A shareholder owning common stock in street name may revoke or change voting instructions by contacting the bank, brokerage firm, or other nominee holding the shares or by participating in and voting during the Annual Meeting.Participating in the Annual MeetingThis year’s Annual Meeting will be accessible through the Internet. We are conducting a virtual online Annual Meeting so our shareholders can participate from any geographic location with Internet connectivity. We believe this enhances accessibility to our Annual Meeting for all of our shareholders and reduces the carbon footprint of our activities.66You are entitled to participate in the Annual Meeting if you were a shareholder as of the close of business on Thursday,Tuesday, April 20, 2023,16, 2024, the record date, or hold a valid proxy for the meeting. To participate in the Annual Meeting, including to vote and to view the list of registered shareholders as of the record date during the meeting, shareholders of record must access the meeting website at www.virtualshareholdermeeting.com/DNA2023DNA2024 and enter the 16-digit control number found on the Notice of Internet Availability of Proxy Materials or on the proxy card(s) provided to you with this Proxy Statement, or that is set forth within the body of the email sent to you with the link to this Proxy Statement. If your shares are held in street name and your Notice of Internet Availability of Proxy Materials or voting instruction form indicates that you may vote those shares through the www.proxyvote.com website, then you may access, participate in, and vote at the Annual Meeting with the 16-digit control number indicated on that Notice of Internet Availability of Proxy Materials or voting instruction form. Otherwise, shareholders who hold their shares in street name should contact their bank, broker, or other nominee and obtain a “legal proxy” in order to be able to attend, participate in, or vote at the Annual Meeting.Regardless of whether you plan to participate in the Annual Meeting, it is important that your shares be represented and voted at the Annual Meeting. Accordingly, we encourage you to vote in advance of the Annual Meeting.Shareholders are able to submit questions for the Annual Meeting’s question and answer session during the meeting through www.virtualshareholdermeeting.com/DNA2023DNA2024. Shareholders who have been provided or obtained a 16-digit control number may submit a question in advance of the meeting at www.proxyvote.com after logging in with that control number. Additional information regarding the rules and procedures for participating in the Annual Meeting (including any adjournment thereof) will be set forth in our meeting rules of conduct, which shareholders can view during the meeting at the meeting website or during the ten days prior to the meeting at www.proxyvote.com.We encourage you to access the Annual Meeting before it begins. Online check-in will be available at 3:7:45 p.m.a.m., Eastern Time, approximately 15 minutes before the meeting starts on Friday,Thursday, June 16, 2023. If you have difficulty accessing the meeting, please call 844-986-0822 (toll free) or 303-562-9302 (international). We13, 2024. There will havebe technicians available to assist you.77ITEM 1 – ELECTION OF DIRECTORSIn accordance with our Bylaws, the Board has fixed the number of directors constituting the Board at nine. The Board, based on the recommendation of the Nominating and Corporate Governance Committee, proposed that the following nine9 nominees be elected at the Annual Meeting, each of whom will hold office until the next Annual Meeting of Shareholders or until his or her successor shall have been elected and qualified:●Arie Belldegrun●Arie Belldegrun●Ross Fubini●Kathy Hopinkah Hannan●Christian Henry●Jason Kelly●Myrtle Potter●Shyam Sankar●Reshma Shetty●Harry E. Sloan7 of 9 nominees are currently directors of Ginkgo. Marijn E. Dekkers●Kathy Hopinkah Hannan●Christian Henry●Jason Kelly● and Reshma Kewalramani●Shyam Sankar●Reshma Shetty●Harry E. SloanEachKewalramani’s terms will expire at the Annual Meeting and they will not be standing for re-election. Ross Fubini and Myrtle Potter are director nominees whose terms would commence on June 13, 2024 if duly elected at the Annual Meeting. As a result, we expect that there will be one Class B Director vacancy on our Board following the Annual Meeting, and holders of the nominees is currentlyour Class B common stock are entitled, pursuant to our Charter and Bylaws, to nominate and appoint a director to fill that vacancy. Although fewer nominees are named in this Proxy Statement than the number currently fixed, proxies cannot be voted for a greater number of Ginkgo.persons than the number of nominees named in this Proxy Statement because only holders of our Class B common stock are entitled to nominate and elect a director to fill the vacancy. Of the nine9 nominees, Jason Kelly and Reshma Shetty have been designated as the two nominees to be elected by holders of the Ginkgo Class B common stock, voting as a separate class. The remaining seven7 nominees are to be elected by holders of Ginkgo Class A common stock and holders of Ginkgo Class B common stock, voting together as a single class. Biographical and related information on each nominee is set forth below.The Board expects that the nine9 nominees will be available to serve as directors. However, if any of them should be unwilling or unable to serve, the Board may decrease the size of the Board or may designate substitute nominees, and the proxies will be voted in favor of any such substitute nominees.The Board of Directors recommendsa vote “FOR”“FOR” each nominee.88Board of Directors InformationIn evaluating the nominees for the Board, the Board and the Nominating and Corporate Governance Committee took into account the qualities they seek for directors, and the directors’ individual qualifications, skills, and background that enable the directors to effectively and productively contribute to the Board’s oversight of Ginkgo, as discussed below in each biography and under “Director Nominee Tenure, Skills, and Characteristics.” When evaluating re-nomination of existing directors, the committee also considers the nominees’ past and ongoing effectiveness on the Board and their independence.Biographical InformationBackgroundDr. Kelly, one of our Founders, is the Chief Executive Officer and a member of Ginkgo’s Board. Dr. Kelly previously served as a director of CM Life Sciences II Inc. (Nasdaq: CMII), a special purpose acquisition company with a focus on the life sciences sector in 2021. Dr. Kelly has a Ph.D. in Biological Engineering and a B.S. in Chemical Engineering and Biology from the Massachusetts Institute of Technology.Qualifications and SkillsWe believe that Dr. Kelly is qualified to serve on our Board as a Founder and due to his knowledge of our company and our business.Chief Executive Officer and

Founder of GinkgoAge: 4243Director since: 2008Board committees: NoneOther current public company boards: NoneBackgroundDr. Shetty, one of our Founders, is the President and Chief Operating Officer and a member of Ginkgo’s Board. Dr. Shetty has a Ph.D. in Biological Engineering from the Massachusetts Institute of Technology and a B.S. in Computer Science from the University of Utah.Qualifications and SkillsWe believe that Dr. Shetty is qualified to serve on our Board as a Founder and due to her knowledge of our company and our business.President, Chief Operating

Officer and Founder of

GinkgoAge: 4243Director since: 2008Board committees: NoneOther current public company boards: None99Arie Belldegrun, M.D.BackgroundDr. Belldegrun has had a distinguished tenure in the life sciences industry, having been closely involved with the founding and advancement of several successful biopharmaceutical companies. Dr. Belldegrun is a leader in the field of cell and gene therapy. Dr. Belldegrun is a co-founderco‐founder of Allogene Therapeutics, Inc., a clinical stage biotechnologypublic biopharmaceutical company, focused on pioneering the development of allogeneic chimeric antigen receptor T cell (AlloCAR T™) therapies for cancer. Heand has served as Executive Chairman of its board of directors since November 2017. From March 2014 until October 2017 Dr. Belldegrun also founded Kite Pharma, Inc., a biopharmaceutical company engaged in the development of innovative cancer immunotherapies, where he served as the President and Chief Executive Officer from March 2014 until its acquisition by Gilead Sciences,of Kite Pharma, Inc. in October 2017 and as a member of its board of directors from June 2009 until October 2017. Dr. Belldegrun is thecurrently serves as Chairman of Bellco Capital LLC a position he has held since 2004. He also serves as(since 2004); Chairman of UroGen Pharma, Ltd. (since December 2012); Chairman and Partner of Two River Group Holdings LLC, a position he has held since(since June 2009, UroGen Pharma, Ltd., a position he has held since December 2012, and Kronos Bio, Inc., a position he has held since November 2017, and as co-Chairman2009); Co‐chairman of Breakthrough Properties LLC a position he has held sinceand Breakthrough Services, L.L.C. (since April 2019. He is the co-Founder2019); Chairman of IconOVirKronos Bio (since November 2017); Co‐chairman of Symbiotic Capital (since June 2023); and Director of ByHeart, Inc. and has served as a member of its board of directors since June 2020, and(since October 2019). Dr. Belldegrun is also the co-FounderSenior Managing Director of Vida Ventures, LLC a life science venture group with offices in Boston and Los Angeles, where he has served as Senior Managing Director since(since November 2017.2017). Dr. Belldegrun is a Research Professor, holds the directorRoy and Carol Doumani Chair in Urologic Oncology, and is Founder and Director of the University of California at Los Angeles’s (“UCLA”)UCLA Institute of Urologic Oncology at the David Geffen School of Medicine at UCLA, where he also is a Research Professor, holding the Roy and Carol Doumani Chair in Urologic Oncology.UCLA. Prior to joining UCLA, Dr. Belldegrun was at the National Cancer Institute/National Institute of HealthNIH as a research fellow in surgical oncology and immunology.immunotherapy under Dr. Belldegrun receivedSteven A. Rosenberg. He completed his M.D. fromMD at the Hebrew University Hadassah Medical School in Israel, after which he completedJerusalem, his post-graduatepost‐graduate studies in Immunology at the Weizmann Institute of Science, and his residency in urologic surgery at Harvard Medical School. Dr. Belldegrun is certified by the American Board of Urology and is a Fellow of the American Association of Genitourinary Surgeons. Dr. BelldegrunHe has authored several books on oncology and more than 500 scientific and medical papers related to urological cancer,cancers, immunotherapy, gene therapy and cancer vaccines.Qualifications and SkillsWe believe that Dr. Belldegrun is qualified to serve on our Board due to his extensive knowledge as a leader in the field of cell and gene therapy.Executive Chairman and

Co-Founder of Allogene

TherapeuticsAge: 7374Director since: 2021Board committees: CompensationOther current public company boards: Allogene Therapeutics, Inc., Kronos Bio, Inc., and UroGen Pharma, Ltd.1010Marijn E. DekkersRoss FubiniBackgroundDr. Dekkers is the FounderRoss Fubini founded XYZ Venture Capital, a venture capital investment firm focused on startups across various sectors, in 2017, and Chairman of Novalis LifeSciences LLC,serves as Managing Director. Mr. Fubini was an investmentearly stage investor in defense tech leader Anduril, cloud-based building security breakout Verkada, and advisory firm for the Life Science industry that he founded in 2017. Before that, from 2010 to 2016, Dr. Dekkersmodern insurance brokerage Newfront. Mr. Fubini also sits on multiple private company boards including Sardine and Legion Technologies. Mr. Fubini served as Chief Executive Officer of Bayer AG. Prior to his time at Bayer, from 2002 to 2009, he served as Chief Executive Officer of Thermo Fisher Scientific. Dr. Dekkers currently serves as a director on the boards of Quantum-SI, Inc.Home Plate Acquisition Corp. from 2021-2023.Prior to XYZ, Mr. Fubini co-founded Village Global and Cerevel Therapeutics Holdings, Inc.,was an investor at both Canaan and Kapor Capital. He has held numerous operating roles, including CTO and co-founder of CubeTree, which was sold to SuccessFactors in 2010, as well as Georgetown Universityled engineering divisions at Symantec and the Foundation for the National InstitutesPlumtree Software.Mr. Fubini has advised and invested in over 200 companies across a range of Health. He is a former director of Unilever, General Electricstages and Biogen. Dr. Dekkers began his career in 1985 as a research scientist at General Electric’s Corporate R&D Center. Dr. Dekkers received his PhDindustries. Since 2010, Mr. Fubini has been involved with supporting executive teams to grow and M.S. in chemical engineering from the University of Eindhoven and his B.S in chemistry from the Radboud University.scale revenue.Qualifications and SkillsWe believe that Dr. DekkersMr. Fubini is qualified to serve on our Board due to his extensive knowledge of the life sciences industry, his familiarity with our companyexpertise and his prior director service.Founder and ChairmanManaging Director of

Novalis LifeSciences, LLCAge: 6548Director since: 2019N/ABoard committees: NoneOther current public company boards: Quantum-SI, Inc. and Cerevel Therapeutics Holdings, Inc.None1111BackgroundDr. Hannan is a retired senior partner from KPMG LLP, where she servedheld numerous leadership roles including her roles as a Global Lead Partner,Vice Chair, National Managing Partner and Vice Chair of Human Resources.Global Lead Partner. She has extensive governance experience through her corporate board roles with Annaly Capital Management (NYSE: NLY), and Otis Worldwide Corporation (NYSE: OTIS), and her previous service at Carpenter Technology Corporation (NYSE: CRS), as well as her previousformer roles as Chair of the Board of Trustees for the Smithsonian National Museum of the American Indian and Chair of the Board of Directors of Girl Scouts of the USA. She also holds a CERT Certificate in Cybersecurity Oversight and is a Certified Public Accountant. A member of the Ho-Chunk Nation, Dr. Hannan served as a commissioner for the Tribal Employment Rights Office and was a presidential appointee to the National Advisory Council on Indian Education. She also served as a member of the Committee to establish the Board of Directors for the Ho-Chunk Tribe’s corporation under Section 17 of the Indian Reorganization Act and was a presidential appointee to the National Advisory Council on Indian Education.Act. She earned her Bachelor degree in Accounting and Political Science from Loras College and a PhD in Leadership Studies from Benedictine University.Qualifications and SkillsWe believe that Dr. Hannan is qualified to serve on our Board due to her over 30 years of experience as a senior C-Suite executive, corporate advisor, independent board director and strategist.Former Senior Partner, KPMG LLPAge: 6162Director since: 2022Board committees: Audit and CompensationOther current public company boards: Annaly Capital Management, Inc., and Otis Worldwide Corporation and Carpenter Technology Corporation1212BackgroundMr. Henry has served as President and Chief Executive Officer of Pacific Biosciences of California, Inc., a leading sequencing company, since September 2020. From 2005 to January 2017, Mr. Henry was a member of the executive team of Illumina, Inc., a global leader in sequencing. During this tenure at Illumina, he served in a number of roles, including Executive Vice President & Chief Commercial Officer, Senior Vice President of Genomic Solutions, Senior Vice President and General Manager of Life Sciences and Senior Vice President and Chief Financial Officer. Prior to joining Illumina in 2005, Mr. Henry served as the Chief Financial Officer of Tickets.com, Inc. from 2003 to 2005. From 1999 to 2003, Mr. Henry served as Vice President, Finance and Corporate Controller of Affymetrix, Inc. (acquired by Thermo Fisher Scientific in 2016). In 1997, Mr. Henry joined Nektar Therapeutics (formerly Inhale Therapeutic Systems, Inc.) as Corporate Controller, and later as its Chief Accounting Officer from 1997 to 1999. In 1996, Mr. Henry served as General Accounting Manager of Sugen, Inc. Mr. Henry began his career in 1992 at Ernst & Young LLP, where he was a Senior Accountant through 1996. Mr. Henry currently serves as a director and Chairman of the board of WAVE Life Sciences Ltd. Mr. Henry previously served as Chairman of the board of Pacific Biosciences of California, Inc. from August 2018 to September 2020 and currently serves as a director. He previously served as a director of CM Life Sciences III Holdings LLC from April 2021 through December 2021. Mr. Henry holds a B.A. in biochemistry and cell biology from the University of California, San Diego and an M.B.A., with a concentration in finance, from the University of California, Irvine.Qualifications and SkillsWe believe that Mr. Henry is qualified to serve on our Board due to his over 20 years of experience in growing companies in the life sciences industry.President and Chief

Executive Officer of Pacific

Biosciences of California,

Inc.Age: 5556Director since: 2016Board committees: Audit and CompensationOther current public company boards: WAVE Life Sciences Ltd., Pacific Biosciences of California, Inc.13Reshma KewalramaniMyrtle PotterBackgroundDr. Kewalramani has beenMs. Potter currently serves as the Chief Executive Officer of Myrtle Potter & Company, LLC, a life sciences advisory firm. Prior to this she served as President, Chief Executive Officer and PresidentChairperson of Vertex Pharmaceuticals Inc. since April 2020 and a member of Vertex’sthe Board of Directors since February 2020. Dr. KewalramaniSumitomo Pharma America, Inc., from July 2023 to April 2024, which was Vertex’sformed through the consolidation of eight U.S. biopharmaceutical companies. Ms. Potter also served as the Chief Executive Officer of Sumitovant Biopharma, Inc., the parent company of five biotechnology subsidiaries, from December 2019 to June 2023. Prior to this, she served as Vant Operating Chair at Roivant Sciences, Inc. from July 2018 to December 2019, where she oversaw thirteen biopharmaceutical companies with over thirty investigational drugs in eleven therapeutic areas. As Chief Executive Officer of Myrtle Potter & Company, LLC, Ms. Potter and her hand-picked team of experts led major strategic efforts and the preparation for multiple product launches for numerous biopharmaceutical companies. From 2000 to 2004, Ms. Potter served as Chief Operating Officer at Genentech, Inc., a biopharmaceutical company, and from 2004 to 2005, she served as the President, Commercial Operations and Executive Vice President of Genentech. Prior to joining Genentech, she held various positions, including President, U.S. Cardiovascular/Metabolics at Bristol-Myers Squibb, and Chief Medical Officer from April 2018 through April 2020. She was Vertex’s Senior Vice President Late Developmentat Merck & Co. While at Merck, she started the company Astra Merck, Inc. which later, through a series of transactions, became a part of AstraZeneca PLC. Ms. Potter currently serves on the Boards of Directors of Guardant Health Inc. and Liberty Mutual Holding Company, Inc. and the Board of Trustees of The University of Chicago. She has previously served on the Boards of Directors of Myovant Sciences, Ltd. from September 2018 to March 2023, Urovant Sciences Ltd. from July 2018 to March 2021, Axsome Therapeutics, Inc. from June 2017 to June 2020, Immunovant, Inc. from June 2019 to February 2017 until March 2018. From August 20042020, Axovant Gene Therapies, Ltd. from September 2018 to January 2017, she served in roles of increasing responsibility at AmgenFebruary 2020, and Arbutus Biopharma, Inc., most recently as Vice President, Global Clinical Development, Nephrology & Metabolic Therapeutic Area from October 2018 to February 2020, and as Vice President, U.S. Medical Organization. From 2014 through 2019, Dr. Kewalramani was the industry representative to the FDA’s Endocrine and Metabolic Drug Advisory Committee. She completed her internship and residency in Internal Medicine at the Massachusetts General Hospital and her fellowship in Nephrology at the Massachusetts General Hospital and Brigham and Women’s Hospital combined program. Dr. KewalramaniAmazon.com, Inc. Ms. Potter holds a B.A.Bachelor of Arts Degree from BostonThe University and an M.D. from Boston University School of Medicine. Dr. Kewalramani also completed the General Management Program at Harvard Business School and is an alumnus of the school.Qualifications and SkillsWe believe that Dr. KewalramaniMs. Potter is qualified to serve on our Board due to her expertise and deep knowledge of AI in the biotechnology industry and her extensive experience serving in senior roles at various pharmaceuticalon boards of public companies.Chief Executive Officer andof

President Vertex

Pharmaceuticals, Inc.Age: 5065Director since: 2021N/ABoard committees: Nominating andNone

Corporate GovernanceOther current public company boards:Vertex Pharmaceuticals, Guardant Health, Inc.1414BackgroundShyam Sankar is chair of Ginkgo’s Board. Mr. Sankar is the Chief Technology Officer and Executive Vice President at Palantir Technologies Inc., where he has worked in various positions since 2006. Prior to his time at Palantir, Mr. Sankar served as the Vice President of Network Management and Director of Business Development for Xoom Corporation. Mr. Sankar has a deep operational background overseeing the development of complex technology from near inception to massive scale. Mr. Sankar received his M.S. in management science and engineering from Stanford University and his B.S. in electrical and computer engineering from Cornell University.Qualifications and SkillsWe believe that Mr. Sankar is qualified to serve on our Board due to his business acumen, leadership experience, and operational background, having overseen the development and expansion of a software company from its near inception through its public listing.Chief Technology Officer and

Executive Vice President at

Palantir Technologies Inc.Age: 4142Director since: 2015Board committees: Audit, Compensation

and Nominating & Corporate GovernanceOther current public company boards: None15BackgroundMr. Sloan is a founder, former public company CEO and a leading investor in the media, entertainment and technology industries. Mr. Sloan is the Chairman and CEO of Eagle Equity Partners II, LLC. Under Mr. Sloan’s leadership, the company has acquired and taken public, through SPACs, several digital media companies including, during 2020, DraftKings and mobile gaming company Skillz. Mr. Sloan has been at the forefront and evolution of the video gaming industry as one of the founding investors and a Board Member of Zenimax/Bethesda Game Studios, the awarding winning studio acquired by Microsoft in March 2021. Mr. Sloan co-founded Soaring Eagle Acquisition Corp. (Nasdaq: SRNGU), which raised $1.725 billion in its IPO in February 2021 and three months later announced its business combination with Boston-based Ginkgo Bioworks, Inc. In January 2022, Mr. Sloan and his partners launched Screaming Eagle Acquisition Corp. With a closing of its initial public offering of 75,000,000 units, at a price of $10 per unit, Screaming Eagle is the largest IPO of a public acquisition vehicle since March 2021. Earlier in his career, Mr. Sloan was Chairman and CEO of MGM Studios and founded and led two public companies in the entertainment media arena, New World Entertainment and SBS broadcasting, S.A., one of Europe’s largest broadcasters. Mr. Sloan is an Associate Professor at the University of California at Los Angeles’s (UCLA) Anderson School of Management and serves on the UCLA Anderson School of Management Board of Visitors and the Executive Board of UCLA Theatre, Film and Television. Mr. Sloan has served as a director of Lions Gate Entertainment Corporation since December 2021 Skillz, Inc. since December 2020 and DraftKings Inc. since April 2020. He was a director of Skillz, Inc. from December 2020 to August 2022, Soaring Eagle Acquisition Corp. from October 2020 until September 2021, Flying Eagle Acquisition Corp. from March 2020 until December 2020 and Diamond Eagle Acquisition Corp. from May 2019 until April 2020, and Videocon d2h Limited from May 2016 until April 2018.2020. Mr. Sloan is also a Trustee of The McCain Institute. Mr. Sloan received his B.A. degree from UCLA and J.D. degree from Loyola Law School.Qualifications and SkillsWe believe that Mr. Sloan is qualified to serve on Board due to his public company experience, including with other similarly structured, previously blank check companies, business leadership, operational experience and operational experience.

Executive Officer of Eagle

Equity Partners II, LLCAge: 7374Director since: 2021Board committees: AuditOther current public company boards: Lions Gate Entertainment Corporation, Skillz Inc. and DraftKings Inc., and Screaming Eagle Acquisition Corp.1615Director Nominee Tenure, Skills, and CharacteristicsThe Nominating and Corporate Governance Committee annually reviews the tenure, performance, and contributions of existing Board members to the extent they are candidates for re-election, and considers all aspects of each candidate’s qualifications and skills in the context of the Company’s needs at that point in time, and, as stated in the Nominating and Corporate Governance Committee Charter, as well as Ginkgo’s Corporate Governance Guidelines, seeks out candidates with an ability to bring diverse perspectives to the Board. The Nominating and Corporate Governance Committee is committed to actively seeking out highly qualified individuals from underrepresented groups to include in the pool from which new Board candidates are chosen. Currently, of our six independent director nominees, two are women, three are from an underrepresented racial/ethnic group, and four have served for less than five or fewer years. Our Board’s composition also represents a balanced approach to director tenure, allowing the Board to benefit from the experience of longer-serving directors combined with fresh perspectives from newer directors. The tenure range of our director nominees is as follows:0-5<5 YearsFiveTwoCorporate GovernanceBoard LeadershipThe Board is responsible for the control and direction of the Company. The Board represents the shareholders, and its primary purpose is to build long-term shareholder value. The Chair of the Board is selected by the Board and currently is Marijn E. Dekkers.Shyam Sankar. Jason Kelly, Ginkgo’s Chief Executive Officer and Founder, and Reshma Shetty, Ginkgo’s President, Chief Operating Officer and Founder, currently serve on the Board. The guidance and direction provided by the Chair of the Board reinforce the Board’s oversight of management and contribute to communication among members of the Board. The Board believes that this leadership structure is appropriate given Drs. Kelly and Shetty provide valuable insight to the Board due to the perspective and experience they bring as Founders and officers. The Board believes that this leadership structure improves the Board’s ability to focus on key policy and operational issues and helps the Company operate in the long-term interests of shareholders.Our Board recognizes that circumstances may change such that a different structure may be warranted to support the Company’s needs. As a result, the Board periodically reviews the Board’s leadership structure and its appropriateness, given the needs of the Board and the Company at such time.17Communications with the BoardWe provide a process for shareholders and other stakeholdersall interested parties to send communications to the Board through the email address investors@ginkgobioworks.com. Information regarding communications with the Board can be found on the Company’s Investor Relations website at16Board.BoardRisk OversightThe Board has extensive involvement in the oversight of risk management related to Ginkgo and its business, while our management is responsible for day-to-day risk assessment and mitigation activities. While the Board retains overall responsibility for risk oversight, the Board has delegated categories related to certain risks to the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. The Audit Committee provides regular reporting to the Board and represents the Board by periodically reviewing Ginkgo’s accounting, reporting and financial practices, including the integrity of its financial statements, the surveillance of administrative and financial controls and its compliance with legal and regulatory requirements. Through its regular meetings with management, including the finance, legal, internal audit, cybersecurity and information security and technology functions, the Audit Committee reviews and discusses all significant areas of Ginkgo’s business and summarizes for the Board all areas of risk and the appropriate mitigating factors. The Compensation Committee is responsible for reviewing the risks associated with our overall compensation program, including our equity-based compensation plans, and is responsible for our executive officer and director compensation. The Nominating and Corporate Governance Committee is responsible for overseeing management of risks related to our corporate governance guidelines and code of business conduct and ethics, as well as CEO succession planning. The Board reviews strategic and operational risk and receives regular reports on committee activities. In addition, the Board receives periodic detailed operating performance reviews from management.Corporate Governance DocumentsPlease visit our investor relations website at https://investors.ginkgobioworks.com/governance, “Governance,” for additional information on our corporate governance, including:●the Code of Business Conduct and Ethics;●the Corporate Governance Guidelines, which includes policies on director stock ownership guidelines and succession planning; and●the charters approved by the Board for the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee.Shareholder EngagementAs a newly public company, Ginkgo remainsis focused on building and maintaining understanding and trust with all of our stakeholders.shareholders and other interested parties. We seek to maintain direct, frequent, and thoughtful dialogue with our shareholders, irrespective of size. As a mission driven company, it is just as important to us18that the public builds a broad understanding of the potential of synthetic biology as a large institutional investor and so we spend significant time engaging with individual retail investors. We utilize multiple mediums for our outreach and engagement including investor conferences, one-on-one meetings, public presentations, and social media to: (i) open and maintain direct lines of communication with our diverse shareholder base; (ii)17Our discussions with shareholders and other stakeholdersinterested parties cover a broad range of topics, including the synthetic biology ecosystem and Ginkgo’s business model, business strategy, financial performance, corporate governance, and the environmental and social implications of our platform. We seek to engage with shareholders year-round on Ginkgo’s vision and value creation opportunities. This direct dialogue with current and prospective shareholders and other stakeholdersinterested parties has not only enabled Ginkgo to share our priorities and vision but also understand shareholder and other stakeholderinterested party feedback and concerns. These observations have helped us to refine our engagement with all our stakeholdersinterested parties and are conveyed to Ginkgo leadership, wherever applicable, so we can continue to improve.Importantly, our employees as a group are currently our largest shareholder, and just as we spend time building an understanding of our value creation opportunities with institutional and retail investors, for instance, we directly engage with our employee shareholders as well. We believe a strong culture of employee ownership and engagement will help drive sustainable long-term value and so we seek to deeply engage our employee shareholders and help employees build a deep understanding of how their work creates real value. As an example of this, directly following our quarterly results calls, we host an open meeting for all employees of the company to ask their questions about our results presentation.Board Meetings and CommitteesThe Board meets regularly during the year and holds special meetings and acts by unanimous written consent whenever circumstances require. During 2022,2023, our Board held 1012 meetings. All incumbent directors attended at least 75% of the aggregate number of meetings of the Board and committees on which they served and which occurred during 2022.The Board has established an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee, each of which is comprised entirely of directors who meet the applicable independence requirements of the New York Stock Exchange (“NYSE”) corporate governance standards.The committees keep the Board informed of their actions and provide assistance to the Board in fulfilling its oversight responsibility to shareholders. The table below provides current membership information as well as meeting information for the last fiscal year.19NameAudit

CommitteeCompensation

CommitteeNominating and

Corporate Governance

CommitteeArie BelldegrunxKathy Hopinkah Hannan1xChristian HenryxxReshma Kewalramani2xShyam Sankar3xxxHarry E. Sloanx18

Committee

Committee

Corporate Governance

CommitteeName Audit

CommitteeCompensation

CommitteeNominating and Corporate Governance Committee Arie Belldegrun x Kathy Hopinkah Hannan1x x x Christian Henry x x Reshma Kewalramani x Shyam Sankar2 x x Harry E. Sloan x Total Meetings 7 6 4 1 Dr.Kathy Hopinkah Hannan was appointed to the Compensation Committee effective as of April 14, 2023.2 Marijn E. Dekkers served on2023, the Audit Committee effective as of December 8, 2023, and the Nominating &and Corporate Governance Committee until Dr. Kewalramani’s appointment on March 25, 2022.April 22, 2024.2 3 Marijn E. DekkersShyam Sankar served on the Audit Committee until Mr. Sankar’sDr. Hannan’s appointment on February 19, 2022.December 8, 2023.The functions performed by these Committees, which are set forth in more detail in their charters, are summarized below.Audit CommitteeGinkgo has an Audit Committee, consisting of Christian Henry, who serves as the chairperson, Harry E. Sloan, and Shyam Sankar. Dr. DekkersKathy Hopinkah Hannan. Mr. Sankar served on the Audit Committee until February 19, 2022.December 8, 2023. Each of Messrs. Henry, SankarSloan and SloanDr. Hannan qualify as an independent director under the NYSE corporate governance standards and the independence requirements of Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Board has determined that Mr. Henry qualifies as an “audit committee financial expert” as such term is defined in Item 407(d)(5) of Regulation S-K and possesses financial sophistication, as defined under the rules of NYSE.The purpose of the Audit Committee is to prepare the Audit Committee report required by the SEC to be included in Ginkgo’s proxy statement and to assist the Board in overseeing and monitoring:(1) the quality and integrity of the financial statements;(2) compliance with legal and regulatory requirements;(3) Ginkgo’s independent registered public accounting firm’s qualifications and independence;(4) the performance of Ginkgo’s internal audit function; and(5) the performance of Ginkgo’s independent registered public accounting firm.The Board has adopted a written charter for the Audit Committee, which is available on Ginkgo’s website.20Compensation CommitteeGinkgo has a Compensation Committee, consisting of Shyam Sankar, who serves as the chairperson, Arie Belldegrun, Christian Henry and Kathy Hopinkah Hannan. Each of Messrs. Sankar, Belldegrun, and Henry and Dr. Hannan qualify as an independent director under the NYSE corporate governance standards.The purpose of the Compensation Committee is to assist the Board in discharging its responsibilities relating to:(1) setting Ginkgo’s compensation programs and the compensation of its executive officers and directors;19(2) monitoring Ginkgo’s incentive and equity-based compensation plans; and(3) preparing the Compensation Committee report required to be included in this proxy statement under the rules and regulations of the SEC.In fulfilling its responsibilities, the Compensation Committee has the authority to delegate any or all of its responsibilities to a subcommittee of the Compensation Committee.The Board has adopted a written charter for the Compensation Committee, which is available on Ginkgo’s website.For a description of the role of the executive officers in recommending compensation and the role of any compensation consultants, please see the sectionsections entitled “Role of Executive Officers”Management” and “Role of the Compensation Consultant” below.Nominating and Corporate Governance CommitteeGinkgo has a Nominating and Corporate Governance Committee, consisting of Reshma Kewalramani, who serves as the chairperson, Shyam Sankar and Shyam Sankar. Dr. Dekkers served on the Nominating and Corporate Governance Committee until March 25, 2022.Kathy Hopinkah Hannan. Each of Dr. Kewalramani, and Mr. Sankar and Dr. Hannan qualify as an independent director under the NYSE corporate governance standards.The purpose of the Nominating and Corporate Governance Committee is to assist the Board in discharging its responsibilities relating to:(1) identifying individuals qualified to become new Board members, consistent with criteria approved by the Board;(2) reviewing the qualifications of incumbent directors to determine whether to recommend them for reelection and selecting, or recommending that the Board select, the director nominees for the next annual meeting of shareholders;(3) identifying Board members qualified to fill vacancies on any Board committee and recommending that the Board appoint the identified member or members to the applicable committee;(4) reviewing and recommending to the Board corporate governance principles applicable to Ginkgo;(5) overseeing the evaluation of the Board and management; and(6) handling such other matters that are specifically delegated to the committee by the Board from time to time.21The Board has adopted a written charter for the Nominating and Corporate Governance Committee, which is available on Ginkgo’s website.Policy Regarding Director Attendance at the Annual MeetingAlthough we do not have a formal policy regarding attendance by members of our Board at the annual meetings of shareholders, we strongly encourage, but do not require, directors to attend. All nine directors then serving attended the 20222023 Annual Meeting of Shareholders.20Director NominationsThe Nominating and Corporate Governance Committee considers candidates for director who are recommended by its members, by other Board members, by shareholders, and by management, as well as those identified by a third-party search firm retained to assist in identifying and evaluating possible candidates. The Nominating and Corporate Governance Committee evaluates director candidates recommended by shareholders in the same way that it evaluates candidates recommended by its members, other members of the Board, or other persons, as described above under “Director Nominee Tenure, Skills, and Characteristics.” Shareholders wishing to submit recommendations for director candidates for consideration by the Nominating and Corporate Governance Committee must provide the following information in writing to the attention of the Secretary of Ginkgo by certified or registered mail:●the name and address of the shareholder making the recommendation;●the class, series, or number of shares of common stock owned of record or beneficially owned by the shareholder making the recommendation;●a representation that the shareholder is a holder of record of stock entitled to vote at the meeting, will continue to be a shareholder of record of the Company entitled to vote at such meeting through the date of such meeting and intends to be present in person at the meeting (including present remotely for meetings held by remote communication);meeting;●certain disclosable interests of the shareholder making the recommendation, as laid out in our Bylaws; and●certain information about the candidate recommended by the shareholder, as laid out in our Bylaws.To be considered by the Nominating and Corporate Governance Committee for the 20242025 Annual Meeting of Shareholders, a director candidate recommendation must be received by the Secretary of Ginkgo no earlier than Saturday,Thursday, February 17, 202413, 2025 and no later than Monday,Saturday, March 18, 2024.15, 2025. However, if we hold the 20242025 Annual Meeting of Shareholders more than 30 days before, or more than 60 days after, the anniversary of the 20232024 Annual Meeting date, then the information must be received no later than (i) the 90th day prior to the 20242025 Annual Meeting date or (ii) the tenth day after public disclosure of the 20242025 Annual Meeting date, whichever is later.Our Bylaws provide a proxy access right for shareholders, pursuant to which a shareholder may include director nominees in our proxy materials for annual meetings of our shareholders. To be eligible to utilize these proxy access provisions, the shareholder, and such candidate for nomination, must satisfy the additional eligibility, procedural, and disclosure requirements set forth in our Bylaws.22In addition to satisfying the requirements under our Bylaws, shareholders who intend to solicit proxies in support of director nominees other than Ginkgo’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act (including a statement that such shareholder intends to solicit the holders of shares representing at least 67% of the voting power of Ginkgo’s shares entitled to vote on the election of directors in support of director nominees other than Ginkgo’s nominees) to comply with the universal proxy rules, which notice must be postmarked or transmitted electronically to Ginkgo at its principal executive offices no later than 60 calendar days prior to the anniversary date of the Annual Meeting (for the 20242025 Annual Meeting, no later than Wednesday,Monday, April 17, 2024)14, 2025). However, if the date of the 20242025 Annual Meeting is changed by more than 30 calendar days from suchthe anniversary date,of the 2024 Annual Meeting, then notice must be provided by the later of 60 calendar days prior to the2120242025 Annual Meeting and the 10th calendar day following the day on which public announcement of the date of the 20242025 Annual Meeting is first made.We reserve the right to reject, rule out of order, or take other appropriate action with respect to any director nomination or stockholdershareholder proposal that does not comply with our Bylaws and other applicable requirements.Compensation of DirectorsGinkgo has an annual compensation program for its non-employee directors pursuant to which the non-employee directors are entitled to cash and equity compensation in such amounts necessary to attract and retain non-employee directors who have the talent and skills to foster long-term value creation and enhance the sustainable development of the Company. The compensation payable under the program is intended to be competitive in relation to both the market in which the Company operates and the nature, complexity and size of Ginkgo’s business.Ginkgo’s non-employee directors receive the following amounts for their services on the Board under the non-employee director compensation program:Cash Compensation●An annual director fee of $50,000; and●In the event that a director serves as lead independent director or chair or on a committee of the Board, an additional annual fee as follows:○Chair of the Board, $36,000;○Lead independent director, $25,000;○Chair of the Audit Committee, $20,000;○Audit Committee member other than the chair, $10,000;○Chair of the Compensation Committee, $15,000;○Compensation Committee member other than the chair, $7,500;○Chair of the Nominating and Corporate Governance Committee, $10,000; and○Nominating and Corporate Governance Committee member other than the chair, $5,000.Director fees are payable in arrears in four equal quarterly installments, provided that the amount of each payment will be prorated for any portion of a calendar quarter that a non-employeenon-23employee director is not serving on the Board. The Board may permit non-employee directors to elect to receive equity compensation in lieu of cash compensation.Equity Compensation●Generally, each non-employee director who is initially elected to the Board will receive (i) an initial option to purchase shares of Ginkgo Class A common stock with a grant date fair value of $400,000 (the “Initial Option”), (ii) an additional initial option to purchase shares of Ginkgo Class A common stock with a grant date fair value of $200,000 (the “Additional Initial Option”), and (iii) a number of restricted stock units (“RSUs”) determined by dividing $200,000 by the closing price of a share of Ginkgo Class A common stock on the date of grant (the “Additional Initial“Initial RSUs”). In the event22that a non-employee director’s date of initial election does not occur on the same date as an annual meeting of shareholders, the value of the Additional Initial Option and the Additional Initial RSUs will be prorated in accordance with the terms of the program.●If a non-employee director has served on the Board as of the date of an annual meeting of shareholders and will continue to serve as a non-employee director immediately following such meeting, such non-employee director will receive (i) an option to purchase shares of Ginkgo Class A common stock with a grant date fair value of $200,000 (the “Subsequent Option”) and (ii) a number of restricted stock units determined by dividing $200,000 by the closing price of a share of Ginkgo Class A common stock on the date of grant (the “Subsequent RSU Award”).Stock options granted under the program have an exercise price equal to the closing price of Ginkgo Class A common stock on the date of grant and expire not later than ten years after the date of grant. Each Initial Option granted to a non-employee director will vest and become exercisable in substantially equal installments on each of the first three anniversaries of the date of grant. Each Additional Initial Option and the Additional Initial RSUs granted to a non-employee director will vest and become exercisable, as applicable, in a single installment on the day before the next annual meeting of shareholders occurring after the date of the director’s initial election or appointment to the Board. Each Subsequent Option and Subsequent RSU Award will vest and become exercisable, as applicable, in a single installment on the earlier of the first anniversary of the date of grant or the day before the next annual meeting of shareholders occurring after the date of grant. Vesting of the options and restricted stock units granted under the program is subject to the non-employee director’s continued service through eachthe applicable vesting date. In the event of a change in control of Ginkgo, the options and restricted stock units granted under the program will vest in full.24The following table sets forth information concerning the compensation of Ginkgo’s non-employee directors for their service on the Board for the year ended December 31, 2022.

or Paid in

Cash ($)(1)

Awards

($)(2)

Awards

($)(2)Name Fees Earned

or Paid in

Cash ($)(1)Stock

Awards

($)(2)Option

Awards